If Charleston wants to cut the city’s revenue by 10 percent, could it wait until after the budget recovers from COVID?

Whether you hate the city’s $3-a-week municipal user fee or tolerate it well enough, you probably like the police protection and paving we get for it. But now lawmakers all the way down in Charleston are having second thoughts.

“We’ve been using one of the very few ways that municipalities in West Virginia can generate revenue,” says Morgantown Mayor Ron Dulaney, “and they’re effectively taking that away from us.”

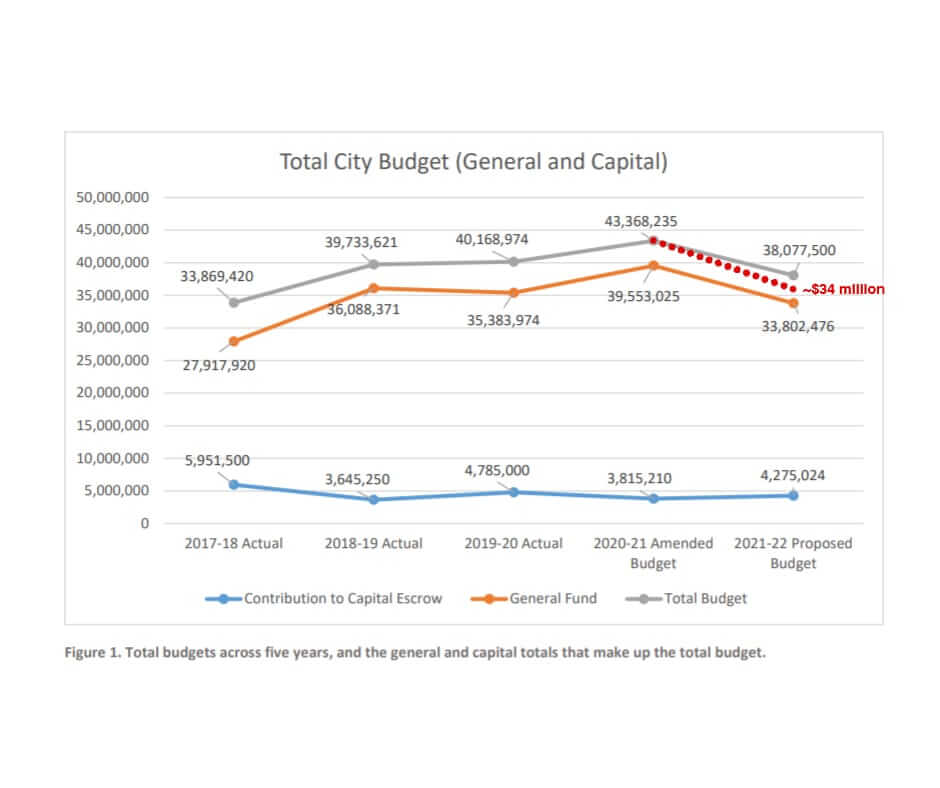

Drawn from the paycheck of everyone who works within city limits since 2016, Morgantown’s municipal user fee is one of 10 user fees in place in cities across the state. It currently contributes about $4 million to Morgantown’s $40 million budget. It pays the salaries of 10 of our 60 or so police officers, and it has caught the city up significantly on repaving secondary roads and improving sidewalks and crosswalks.

Cities’ ability to enact user fees has been one of the successes of home rule, the experiment that highly centralized West Virginia launched in 2007 to cautiously, sparingly grant more decision-making power to local governments—an experiment that has widely been considered a success at every step.

The user fee mechanism is not perfect, Dulaney points out: Because it draws the same amount from each person’s paycheck, it falls far more heavily on fast-food workers than on doctors and lawyers. And while some people who work in the city but live outside it like to call it taxation without representation, the fact is that it’s a fee, not a tax.

But even with the user fee a possibility, cities’ options for generating revenue are limited.

“In many other states, the primary means of raising revenue for municipalities is personal property taxes. Here we’re still using an antiquated system that relies primarily on the business and occupation tax,” Dulaney says. The options for supplementing it are:

- Personal property taxes, which the state limits for municipalities;

- The fire fee, which directly supports the Fire Department;

- The 1% municipal sales and use tax that Morgantown started charging on July 1, 2020; and

- The municipal user fee.

They’re all fairly well maxed out in Morgantown, Dulaney says, “so to take one of those away from us doesn’t leave us options for how to replace that revenue.”

What’s worse is the timing of House Bill 2256 and its amendment that would end the user fee, coming as they do as municipalities across the state are struggling with pandemic-related revenue losses. “We’ve worked really hard during COVID to not be in a position where we had to lay anyone off or reduce positions,” Dulaney says. “We’ve left some positions unfilled that were open. I’m not sure that it’s going to be possible to continue that if this gets approved.”

Rather than simply taking a tool away from cities, Dulaney suggests, a better approach would be to consider the toolbox as a whole. “Ultimately, we should focus on a statewide change in the overall tax structure and rethink completely how municipalities generate revenue,” he says. “But it can’t be piecemeal—we need to look at the issue holistically and the impact that such reductions can have on the services we provide.”

H.B. 2256 is currently in the House Finance Committee. Love or hate the user fee, if you have an opinion about whether decision-making should rest at the local level or elsewhere, or if you have something to say about whether municipal options for generating revenue should be considered piecemeal or as a whole, here’s who to tell: Our local Delegates Joe Statler and John Williams are on the House Finance Committee. And Delegate Eric Householder chairs it.

Leave a Reply